It’s the great marketing catch-22: You need visitor data in order to create value-filled, personalized, highly targeted offers. The more information they provide, the greater your ability to build personas that fit your ideal customers.

But your visitors still aren’t convinced. Like jittery fish, you’ve presented them with the tastiest bait, and they’re hesitant to even take a nibble. So how can you get the information you need without scaring them off?

The answer is…

Progressive profiling.

What is Progressive Profiling?

Progressive profiling uses dynamic form fields to ask for and collect information on prospects based on the information you already have about them. Like a first date, it gets to know new customers in a way that’s gentle and unassuming. What’s your name? What’s the best email address to contact you at? How can I help?

Then, as the customer’s interaction with your product or service continues and greater trust and brand recognition is built, more questions are asked – helping you not just capture leads, but build on the intelligence you’ve gained.

Progressive profiling may start with name, email and question, but can gradually lead to vital details that will help you better understand where your prospect is in the buying cycle: are they evaluating products? Comparing features? Focused on pricing?

Asking questions about their timeframe to purchase and where they are in the decision-making process can help you better understand how and where your product fits according to their needs. Understanding how they plan to use the product can give you valuable insights into tailoring your offer across every stage, leveraging the information you already have about them.

How Does It Work?

Let’s say you sell a product and you have an email newsletter filled with valuable tips and techniques on using it. As is often the case, your prospective customer is asked for their name and email address. Simple enough, right?

They subscribe and get their first couple of newsletters. They’re starting to feel comfortable with your brand and enjoy what they’re getting so far. Here’s where the progressive part comes in. You’ve got another freebie for them – you just need a bit more information about how they plan on using your product, when they plan to purchase, and approximately how much they plan to spend.

Since you don’t need their name and email address again, the form simply asks the relevant questions you’ve set up. This information helps you gradually begin to understand this customer based on how much they’re willing to share as your relationship with them progresses.

Obviously you’ll want to space these out and give as much as you get – take the time to answer questions, clarify features and options, and so on. Don’t expect the customer to be receptive to answering personal questions by day 2.

Don’t Forget Your Best Practices

In addition, you’re not going to want to throw best form practices out the window when implementing progressive profiling. Things like:

Being Clear about What Information is Needed (And How It Should Be Presented)

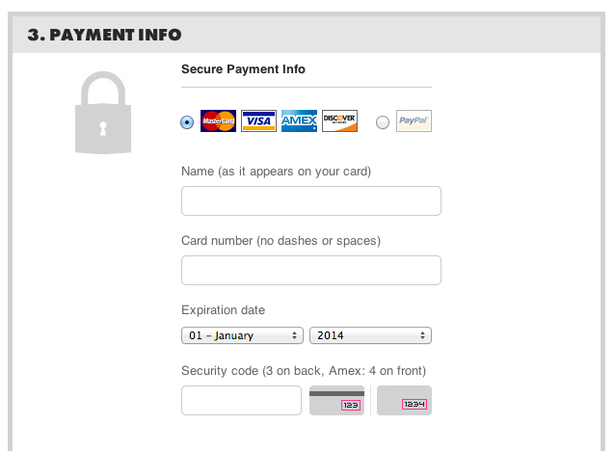

This example from Threadless tells customers precisely how to enter their payment information.

Explaining, if Necessary, Why Certain Information is Needed

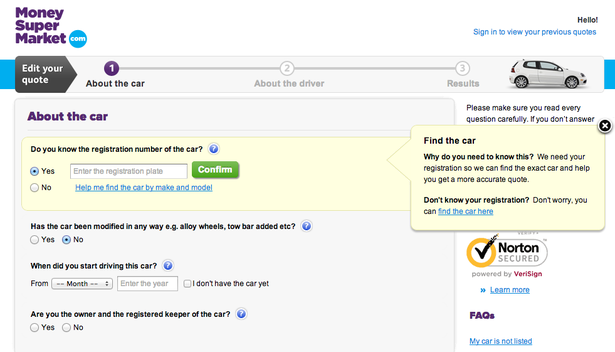

The example below, from Money Supermarket tells people why they need the registration number of their car.

Source: eConsultancy

Make sure your reasoning is reasonable – Money Supermarket could have said, “We need your information to help get you an accurate quote”, but it still wouldn’t answer the prospect’s why? The fact that they need it to find that same exact car and get you a quote is much more sensible.

What Happens After They Subscribe?

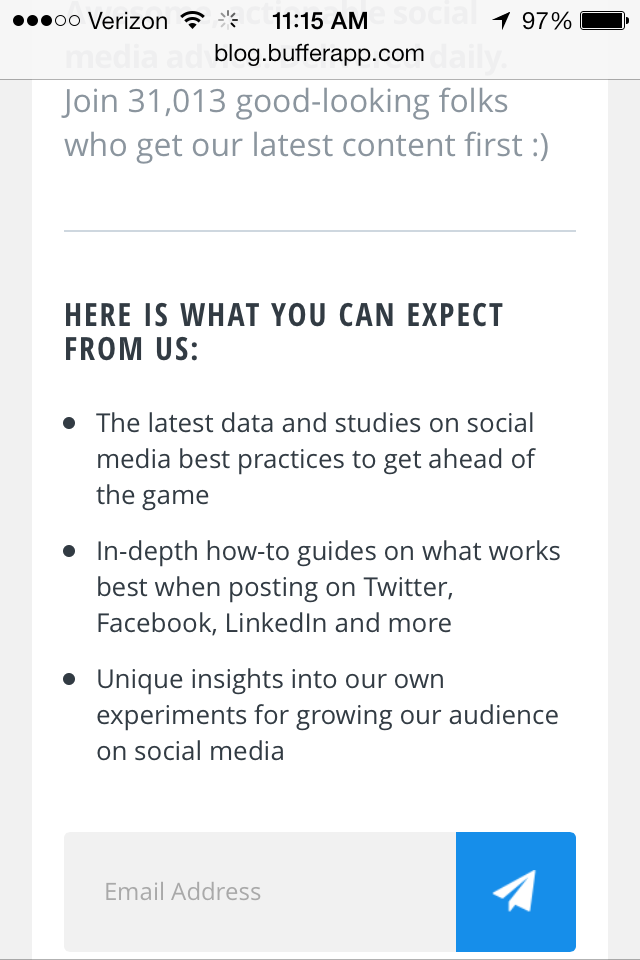

And finally, don’t forget to be clear about what happens after the sign up process is complete. How can they download the freebie? How often will they receive email newsletters? Can they unsubscribe or change the frequency? And so on.

BufferApp sets newsletter expectations before asking for subscribers’ info

How Can You Implement Progressive Profiling?

Progressive profiling is a relatively new function, but there are a variety of solutions on the market that make integrating it into forms easy and hassle-free. Oftentimes, you can do this without any programming knowledge at all. Here are a few services that offer Progressive Profiling as part of their systems:

Salesforce Pardot

Adds a progressive profiling feature that ties in with your existing use of Salesforce Pardot

HubSpot

HubSpot refers to progressive profiling form capabilities as “Smart Forms” and provides a variety of best practices you can follow when implementing them.

Act-On

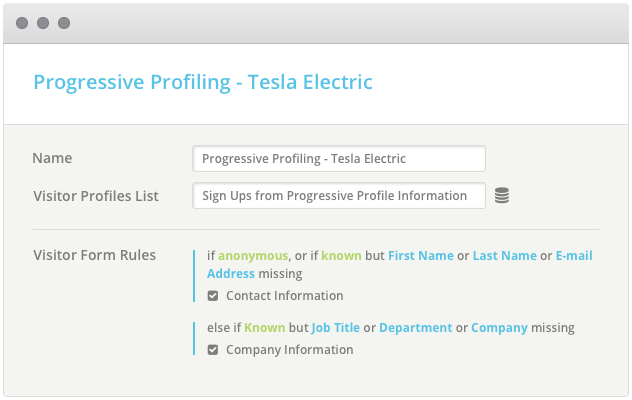

As with other services, Act-On lets you define a set of rules for which other form fields will display. The site also provides an example tour through how its Progressive Profiling system works.

JumpLead

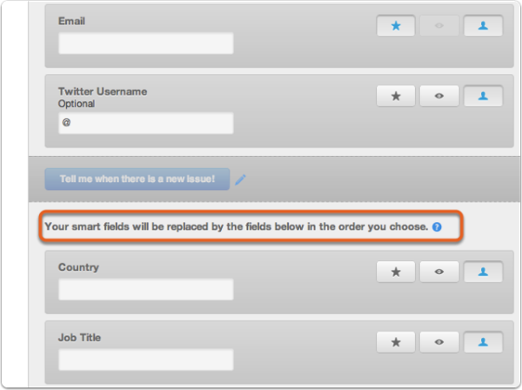

An example of the JumpLead dashboard

JumpLead is a sort of marketing automation/lead generation platform of which progressive profiling forms play a role. Like many of these other solutions, they offer a full scale of marketing automation tools. For WordPress users, JumpLead also has a plugin that can integrate progressive profiling into their existing WordPress system.

How to Get the Best Possible Results from Your New Progressive Forms

It’s easy to fall into the tempting trap of asking for more and more information through more and more form fields as your relationship with the prospect progresses. However, small bits over time (and depending on the customer’s stage in the product’s overall lifecycle, as well as their buying cycle) will help foster a reciprocal relationship while giving them the personal attention and nurturing they crave.

And don’t forget, progressive profiling is just one tool of many designed to help improve your forms and increase your conversion rates. As with any tool, it’s not a silver bullet – it’s all in how you use it. By making progressive profiling a part of your overall sales and conversion optimization process rather than looking at it as “yet another form component”, you’ll be poised to start forming lucrative customer relationships built on a foundation of mutual trust, understanding and expectations.

Now It’s Your Turn

Are you using progressive profiling in your own lead generation forms? How has it worked out for you so far? Share your success stories and triumphs with us, as well as your thoughts on this unique practice in the comments below!

About the Author: Sherice Jacob helps business owners improve website design and increase conversion rates through compelling copywriting, user-friendly design and smart analytics analysis. Learn more at iElectrify.com and download your free web copy tune-up and conversion checklist today!